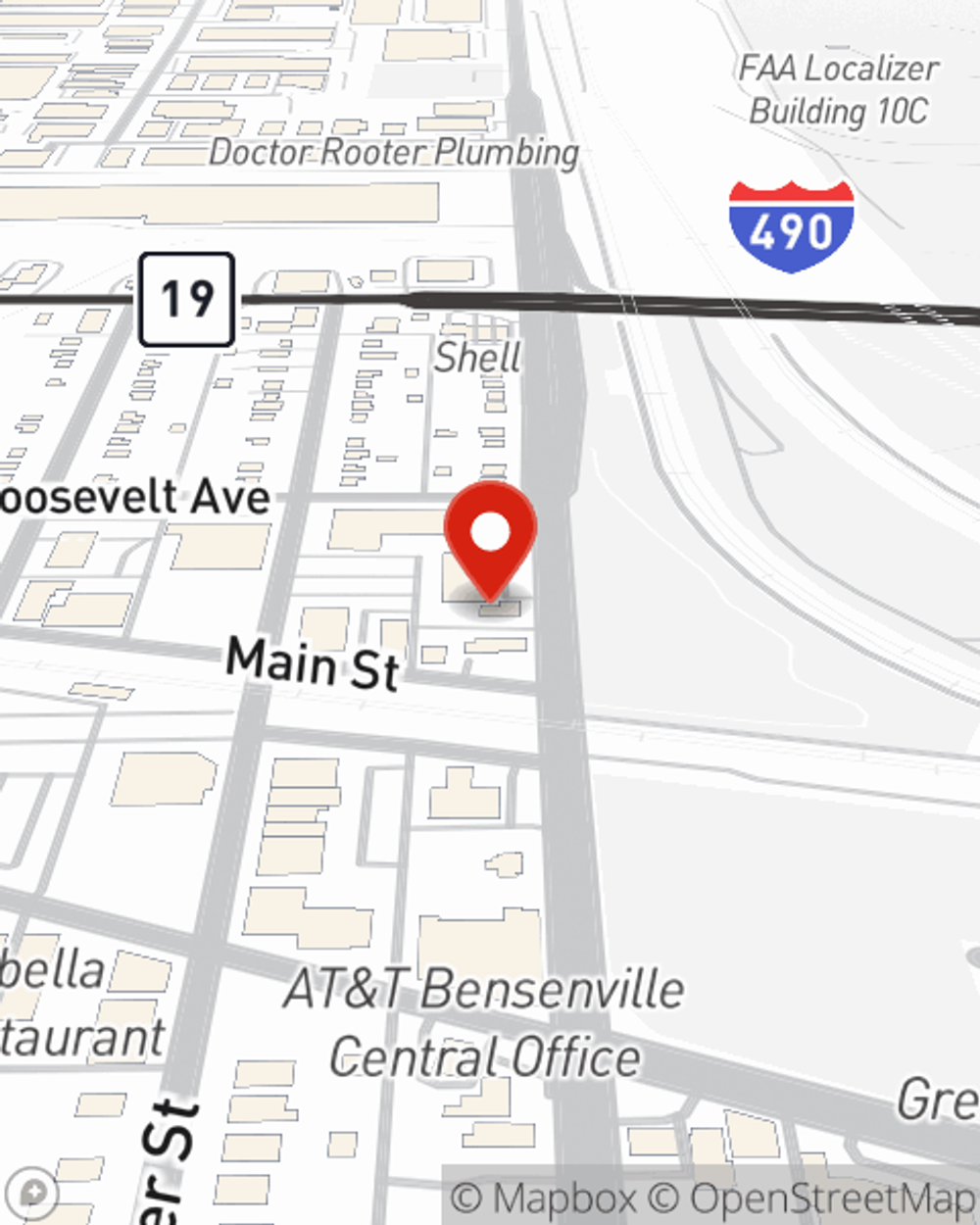

Business Insurance in and around Bensenville

Get your Bensenville business covered, right here!

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like an employee gets hurt on your property.

Get your Bensenville business covered, right here!

Insure your business, intentionally

Protect Your Business With State Farm

With options like extra liability, worker's compensation for your employees, errors and omissions liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent Armando Perez is here to help you customize your policy and can assist you in submitting a claim when the unexpected does happen.

Take the next step of preparation and contact State Farm agent Armando Perez's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Armando Perez

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.